BEAF Loans

Are you planning to add or remodel outdoor seating? Looking into major building improvements? Funding is available through the Downtown Danville Partnership (DDP) to help your business thrive.

The Business Expansion & Attraction Fund (BEAF) is a loan-based program designed to support businesses and property owners as they improve, expand, and enhance their downtown Danville buildings. Funding is awarded through a competitive application process that includes a committee review panel and full DDP board consideration and approval.

Read below to find out if you qualify and learn more about securing funding for your business’s growth.

Applicant Eligibility:

- Applicants must in good standing with the Downtown Danville Partnership

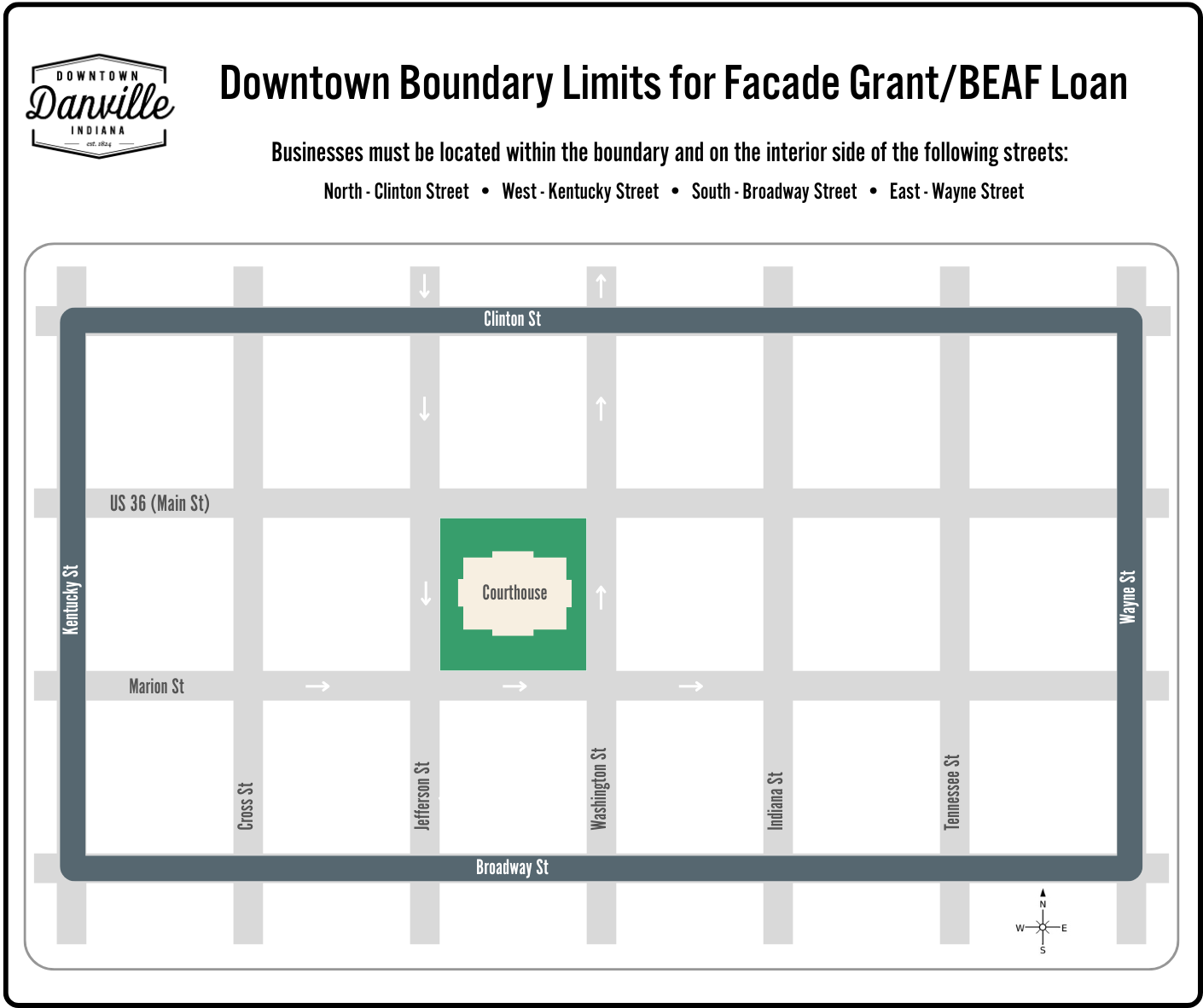

- Applicants must be located in the eligible Downtown Danville area. (See map below.)

- Applicants must have prior approval from the Town of Danville. (See Step 3 of the Application Process.)

- Applicants approved for BEAF Loans or Façade Grants may not apply for additional funds for a period of one (1) year after distribution of awarded funds.

- Applicants cannot be Employees of the Town of Danville (full-time/part-time employees and members of the Town Council) or their immediate family members, as individuals or as principal agent or owner/co-owners of a business.

Project Eligibility:

- Projects cannot have already been started/completed prior to application approval.

- All projects must begin within one (1) year of approval by the Town of Danville’s Design Review Committee.

- Project must have prior approval from landlord/property owner.

Possible eligible projects include (but are not limited to):

- Financing permanent working capital or fixed asset purchases

- Leasehold improvements or expansions*

- Building improvements and enhancements*

- Window/outdoor seating construction or remodeling

*Landlord/property owner participation required

Ineligible projects include (but are not limited to):

- Financing inventory

- Projects already underway or started

- Bank refinancing of debt

- Residential construction or passive real estate

- Compensate for a business weakness

- Acquiring land

- Paying off credit card debt or any taxes

Application Process

- Confirm you meet all above eligibility requirements and can adhere to the loan details.

- Identify the details of your project. Note: Projects currently underway or already completed are not eligible.

- Contact Lesa Ternet, Danville Town Planner, at Lternet@danvillein.gov for ordinance and zoning reviews and guidance on one of two possible next steps:

- Design Review Required: If it is identified that an official design review is required for the project, you will submit your request to the Town of Danville’s Design Review Committee for approval. Follow all necessary steps for approval as directed by the Town Planner.

- Design Review NOT Required: If it is identified that a design review is not required, you will receive a written statement from the Town Planner that design committee approval is not required. (Note: Save this statement for your application in Step 4.)

- Complete/Submit the below BEAF Loan Application through the Downtown Danville Partnership.*

*Once an application is submitted, please allow for up to 30 business days for committee review and approval/denial decision. During this time, you may be contacted for additional information or clarifications.

If your loan is approved…

- The DDP will prepare a commitment letter confirming the details of the loan and describing the documents the borrower will need to provide to close the loan.

- The Partnership will produce documents for closing, including a promissory note, resolutions and all collateral documents. The borrower will need to provide proof of collateral, if required, and other necessary documents for closing.

- The DDP will award the borrower the loan amount by check.

Loan Details:

- Interest rate: Prime +1 shall be adjusted annually

- Personal guaranty is required

- Loan Duration and Amortization:

- Loans over $10,000: Not to exceed 7 years

- Loans from $5,000 – $9,999: Not to exceed 3 years

- Loans below $5,000: Not to exceed 3 years with a minimum monthly payment required of not less than $50

- No Pre-payment Penalty

- UCC-1 security interest required on all personal property/business assets

- Borrow required to provide a formal acceptance letter upon receipt of Commitment Letter

- Additional collateral may be required

Loan Administration Process, if approved:

- Borrower will be billed on a monthly basis by the DDP.

- Borrower will make equal monthly payments to the DDP for principal and interest.

- Monthly loan payments will be due on the due date specified for each month. Note: A grace period beyond the due date stated on the promissory note will be given to each borrower and payments received during the grace period will not accrue a late fee.

- The DDP will conduct a site visit shortly after the check is issued to verify that the loan proceeds were used as stipulated in the loan application.

- If necessary, the DDP may ask the borrower to submit quarterly financial statements until the borrower is able to meet the monthly loan payments. Reasonable efforts will be made to work with the borrower to avoid going into default.

BEAF Loan Application

"*" indicates required fields